Wholesale mortgage lenders are in a unique situation when it comes to marketing their agents and services. Both retail and wholesale lenders work in highly competitive environments, and unlike retail lenders, who serve home buyers directly, wholesale lenders work with brokers. Wholesale lenders need to attract brokers and loan dealers not only on rates, but differentiate themselves in a crowded, and increasingly digital market. As volume increases, the service that you provide your customers should not decrease.

Experience.com (Formerly SocialSurvey) (formerly SocialSurvey) has been working with mortgage companies for years, and recently partnered with wholesale lenders to help develop customer experience and reputation management programs. We wanted to showcase some of their success building a strong CX program and the types of automated feedback that they can now collect and share to build new business.

How does Experience.com (Formerly SocialSurvey) work with wholesalers?

1. Custom CX Whiteboarding Session

Our CX onboarding team does a custom whiteboarding session to help determine goals, customer journeys, and sets up a full hierarchy structure, so every individual agent can launch personalized campaigns, all rolling to the main corporate company.

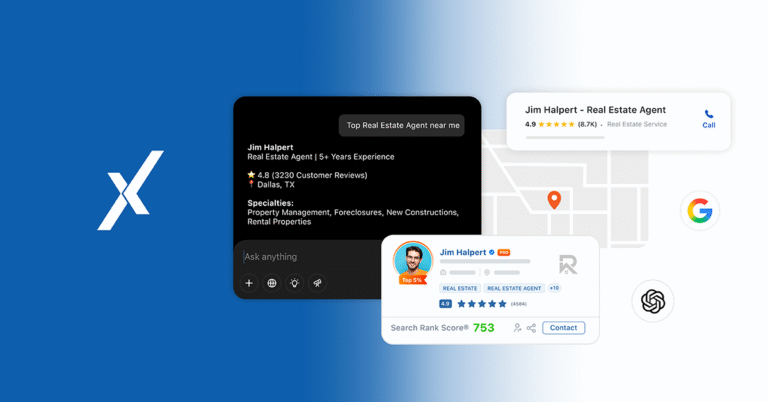

2. Build out profile pages

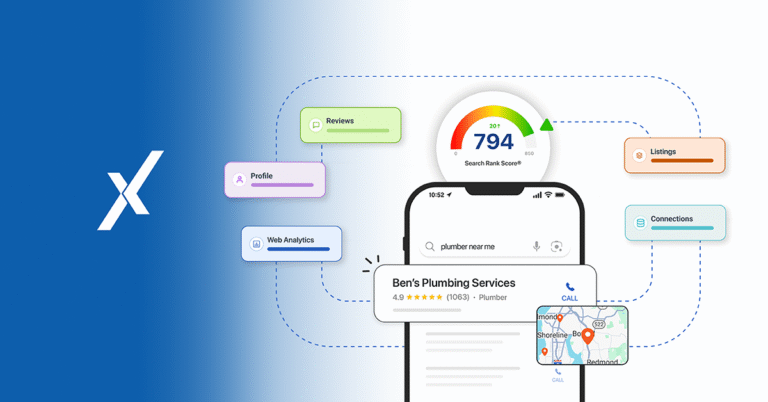

Build individual profile pages for each agent that rolls into the tier structure of your company (teams, locations, branches – however your business is organized, roll under your account, so individual efforts and reviews are captured at each tier of the business. All agents ratings and reviews aggregate for increased ROI and search results.

3. Automate Personalized Surveys

Create employee-personalized surveys that send after each deal has closed. This is automated through your loan operation or other transactional system. That way, you capture 1-on-1 feedback without manually needing to press send each time. And that feedback is tied to Christopher Yin, not location #254.

4. Share Reviews Everywhere

Build custom workflows that escalate negative responses and share positive responses, prompting happy customers to leave reviews on top social and mortgage-specific sites. We can share your reviews directly to your LendingTree or Mortgage Coach profile (and pull those reviews into your Experience.com (Formerly SocialSurvey) profile).

5. Boost online reputation further

Manage your online listings data to boost your Google rankings and be found and monitor agent social media for compliance.

6. Boost Employee Engagement

Build healthy competition and boost employee engagement with score boarding based on employee CX data. You can even connect your platform to your HR systems, so you can reward employees for their great work and positive reviews.

The Power of Experience.com (Formerly SocialSurvey)

Our mortgage clients report a 10-40% revenue increase just one year after implementing Experience.com (Formerly SocialSurvey) CX program. Check out how these four wholesale lenders are changing their business and proving strong ROI after implementing the Experience.com (Formerly SocialSurvey) XMP.

Wholesaler Company 1

Since launching their CX program with Experience.com (Formerly SocialSurvey), thousands of reviews have flooded in, earning them an overall star rating of 4.84. With a complex hierarchy of locations and branches, over 300 employees are now getting direct CX feedback. Before implementing Experience.com (Formerly SocialSurvey), their feedback was scattered all over the internet. Now, each agent’s reviews can be viewed on an individual, team, region or company level.

Agent’s individual profiles aggregate company information, location, and reviews across many sources, including Zillow. Every good experience from an employee not only powered their reputation, but also their location, region, and overall company’s reputation. That’s the power of the hierarchy.

The quality and volume of their reviews has improved their online visibility, pushing their company website to #6 on organic Google search for “mortgage wholesale.” They’ve since reported more online leads funneling to their business. Experience.com (Formerly SocialSurvey) also helped them set up a “Find a Loan Officer” page on their company website, so prospects can quickly find the best professional near them.

Wholesale Company 2

When we work on visibility for brands with many regions, we make sure the impact trickles down to all individual locations. Our CX team worked with this company, a smaller branch of a large mortgage lender, to determine the key customer touch points to measure for maximum impact. In just one year with Experience.com (Formerly SocialSurvey), they rolled in over 141 reviews across just two agents, and have a nearly perfect star rating of 4.94.

Our platform also pulled in their past reviews from Zillow, housing all of relevant praise in one central location. To amplify their happy customers’ voices even further, they can share reviews to Facebook, LinkedIn, or Twitter with the click of a button.

Wholesale Company 3

With our scalable CX program, this company maintains a 4.83 overall star rating across 17 locations. After white boarding the most impactful ways to implement automated workflows for feedback, they now have over 3,500 reviews. With so much consistent feedback, they not only build their online visibility and reputation, but know exactly where to take action to become stronger CX leaders. Even better, with Experience.com (Formerly SocialSurvey) as their customers’ first stop for reviews, they can easily escalate unhappy customers before they take to Google, Zillow or other review sites to harm their reputation.

They also take advantage of Experience.com (Formerly SocialSurvey)’s feature of replying to reviews, whether it’s a great review or a frustrated one. This allows them to form deeper relationships with happy clients and make any unhappy clients feel heard and cared for (before they harm their reputation).

Wholesale Company 4

With our platform, this company has easily been able to collect and analyze feedback with a customized survey, then power business outcomes to continually improve their score over time. Across their two locations, they’ve accumulated a 4.64 star rating from 175 reviews!

They also closely monitor their Google star-rating (currently a 4.5) and keep up with their customers. With Experience.com (Formerly SocialSurvey)’s resolution workflows, the team can be notified right away of any poor review, and reach out to the client. Since they can connect their loan origination systems to their platform, the team immediately can identify the employee who worked with the customer and take action.

Consistently replying to reviews demonstrates to Google and onlooking customers that you’re attentive and care about your customers. This signals to Google that you’re a local, trustworthy business– and Google revealed it improves your local search ranking based off reply to reviews. If a company takes the time to reply and try to understand these issues, they find they can often turn a detractor into a promoter.

Wholesale mortgage lenders are using Experience.com (Formerly SocialSurvey)’s robust XMP to understand how their customers feel about their experiences, analyze and investigate negative feedback, and amplify their positive feedback on key social and industry sites. Individual lender reviews power their office reputation, their branch and divisional reputation, and their overall company reputation. The power of automation means that your team can spend more time working with clients, while benefiting from a constant stream of actionable feedback.