Don’t just meet your customers’ expectations—exceed them!

You’re reading the second part of our series focused on the importance of customer experience throughout the insurance claims journey. Having established the high stakes of customer retention in the insurance industry in our first article, we now turn our attention to the critical moment so pivotal to customer loyalty: the claims process.

This article is dedicated to understanding the customer’s perspective during claims, the impact of their experience on retention, and the deeper human aspects beyond mere transactional interactions.

Ensure you’re fully versed in the conversation by revisiting our initial discussion on customer retention, and stay tuned for our final installment where we introduce Experience.com’s transformative approach to the claims journey.

The Moment of Truth – The Claims Experience

In our previous discussion, we discussed the high stakes of customer retention in the insurance industry, highlighting the significant costs associated with customer acquisition and the pivotal role of the claims process in retaining customers. As we navigate further, it becomes clear that the claims experience isn’t just a step in the customer journey — it’s the moment of truth that can significantly influence a customer’s loyalty. Understanding this journey from the customer’s perspective, with all its potential frustrations and touchpoints, is critical for any insurance company aiming to optimize the claims process and improve retention rates.

Understanding the Customer’s Journey in Claims Process

When a customer files a claim, they’re often in a state of stress, uncertainty, and vulnerability — they’ve just experienced a loss or a disruption that necessitates the claim.

The journey begins with them notifying the insurance company, followed by a waiting period that can be anxiety-inducing. Then comes the adjustment assessment, requiring the customer to provide necessary documentation and possibly negotiate settlements.

Common pain points during this process include complex paperwork, unclear instructions, lack of communication or updates from the insurer, and delays in claim settlement. All these factors compound the stress and dissatisfaction customers may already be feeling due to their loss, leading to a situation where the relationship can be strained.

The Impact of Claims Experience on Retention

A seamless, supportive claims process can solidify customer trust and loyalty, while a negative experience can prompt customers to consider alternative insurers. For instance, consider two scenarios:

A customer involved in an auto accident submits a claim and receives regular updates, transparent communication, and a settlement within the short span of two weeks. The efficiency and support provided during this stressful time result in a positive experience, increasing the likelihood of policy renewal.

Another customer, facing a similar incident, undergoes a lengthy, confusing claims process, encounters unresponsive agents, and finally receives compensation after several months. This ordeal leaves a lasting negative impression, and despite eventual compensation, the customer decides to switch providers at the next opportunity.

These scenarios underscore how the claims experience is integral in determining whether a customer stays or leaves.

Beyond Compensation: Emotional Support and Communication

Compensation is just one aspect of the claims process. Emotional support and clear communication are equally crucial in providing a holistic, positive experience. Customers need to feel heard, understood, and supported.

Strategies to enhance these interpersonal aspects include training staff to show empathy, providing clear, jargon-free communication, proactively updating customers about their claim status, and establishing a straightforward, efficient process for filing claims. Additionally, providing resources to help customers understand what to expect can alleviate anxiety and build confidence in the insurer-customer relationship.

In Conclusion

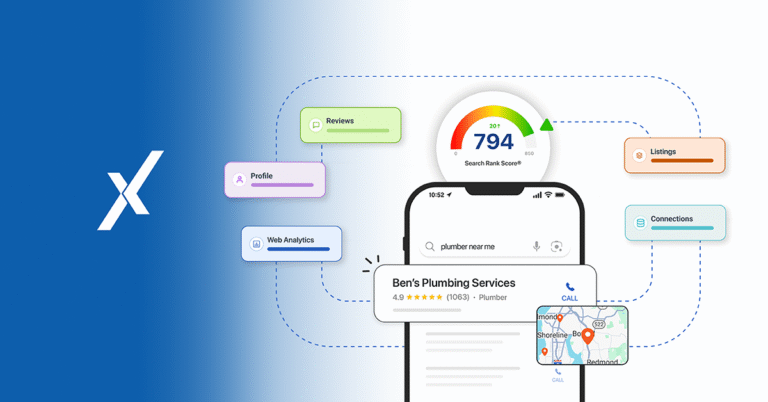

The claims experience is a decisive factor influencing customer retention in insurance. It’s not solely about the financial transaction but the entire journey a customer undergoes during the claim — the emotional support, communication, and overall service they receive. Insurers that prioritize a customer-centric approach in claims processing are more likely to build lasting loyalty, a crucial component for sustainable growth. As we move to our next discussion, we will introduce a promising solution that can revolutionize the claims experience, setting the stage for increased efficiencies, enhance customer satisfaction and, ultimately, higher retention rates.

Click here to navigate to Article 3: Revolutionizing the Claims Journey: How Experience.com Provides the Solution

Inspired to reshape your claims process into an opportunity for boosting customer loyalty and retention? Let’s make it happen together!

Book a Demo with Experience.com to discover the power of optimized claims experiences. Elevate every interaction, drive retention, and set the stage for sustained success.