Don’t just meet your customers’ expectations—exceed them!

We’ve reached the concluding chapter of our insightful series on customer experience in the insurance claims journey. After highlighting the significant costs of customer acquisition and the decisive role of the claims process in customer retention, it’s time to explore the solution.

If you haven’t yet, we encourage you to gain valuable insights from our previous discussions on the economics of customer retention and the pivotal role of the claims experience in fostering customer loyalty.

Experience.com’s Innovative Approach to the Claims Journey

Focusing on moment-based communication and feedback collection at critical points in the claims journey enables unrivaled transparency. Claims Leaders can leverage to optimize claims process. It’s also where Experience.com is distinctly able to add value with actionable insights leaders can leverage. This methodology fosters a seamless dialogue between the insurance provider and the customer, ensuring that feedback is timely, relevant, and actionable.

By design, the Experience.com platform connects and routes this valuable data directly with the individuals and teams responsible for delivering the service. It’s not just about gathering information; it’s about enabling real-time, meaningful decisions and interactions, and making customers feel heard and valued throughout the claims process.

Driving Employee Engagement and Performance

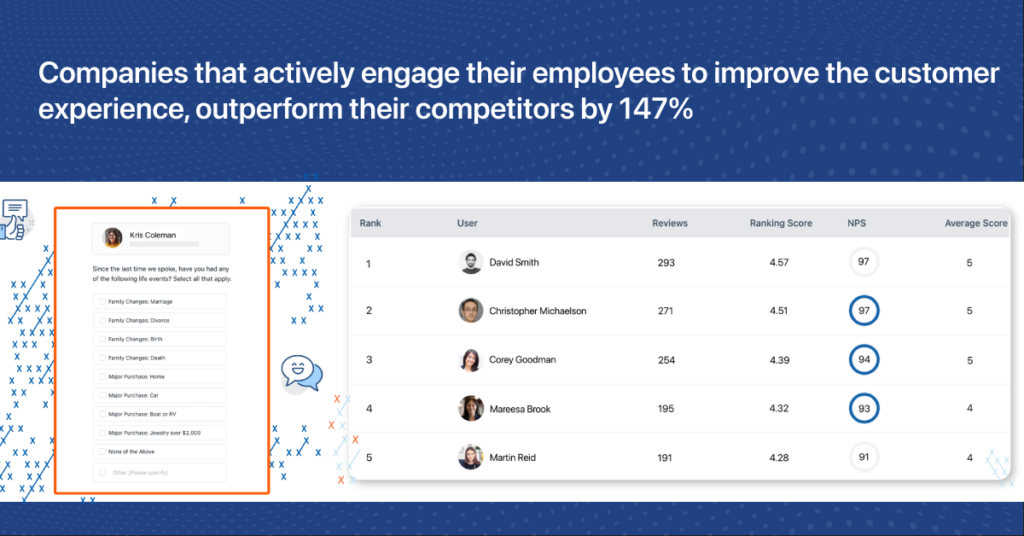

Even in today’s increasingly digital environment, employees, including Claims Handlers, CSR’s, Adjusters and others remain crucial to successfully executing claims processes. What truly sets Experience.com apart is its ability to influence positive employee behaviors, directly impacting the quality of customer interactions. Through the use of scorecards, leaderboards, and real-time alerts, employees become actively engaged in the customer experience process. These tools tap into the intrinsic motivators of staff — ego, competitiveness, and compensation — creating a workforce that’s not just responsive but also proactive in delivering exceptional customer service.

The results speak for themselves: companies have witnessed up to a 50-point surge in NPS scores and a 4% climb in post-loss retention rates. By integrating these performance metrics with payroll, Experience.com ensures that delivering premium customer service isn’t optional; it’s a fundamental aspect of an employee’s role and remuneration.

Empowering Agents as Customer Advocates

Experience.com recognizes the pivotal role Claims personnel play as customer advocates, especially during the claims process. The platform facilitates constant communication with agents, providing them with real-time updates on the customer’s experience. Armed with this information, personnels or leaders can intervene when necessary, advocating for the customer and significantly elevating the customer’s experience and retention likelihood.

This proactive approach transforms agents from passive participants to active guardians of the customer experience, fostering trust and loyalty even in post-loss scenarios.

Scalability: A Solution for Every Size

Whether an insurance provider has a hundred call center agents or a hundred thousand, fifty adjusters or ten thousand, Experience.com scales to meet the demand. It’s not just about collecting data; it’s about driving improved behavior across every level of the organization, ensuring that exceptional customer service is ingrained in the company culture.

This scalable approach means that insurance providers of any size can put customer retention on autopilot, confident in the knowledge that every employee is aligned with the company’s customer-centric goals.

In Conclusion

As we wrap up this series, it’s clear that Customer Experience, Claims Experience and post-claims retention are critical, and that Experience.com isn’t just a solution; it’s the strategic partner insurance companies need in today’s competitive landscape. By harnessing the power of real-time feedback, employee engagement, and scalable solutions, insurance providers can revolutionize the claims process, turning it from a potential pain point into a powerful retention tool.

The opportunity for transformation is here. With Experience.com, insurance providers can navigate the complexities of claims process optimization, ensuring they not only survive but thrive in an era where the customer experience reigns supreme.

Ready to be the change your customers are looking for? Embark on the journey to superior claims experience and retention now!

Book a Demo with Experience.com and unlock the full potential of every customer interaction. It’s time to leverage innovative technology for high-impact results across all stages of the claims journey.