Building a Culture of Customer-First Service

For Ruoff Mortgage, success isn’t just about closing loans—it’s about nurturing lifelong relationships with clients. A family-owned mortgage company led by CEO Mark Music and President Blake Music, Ruoff has embedded customer satisfaction into the DNA of its business.

As Leah Schoenle, their Director of Partnerships and PR, explains:

“It really starts with our leadership. Mark is very, very focused on customer satisfaction and the overall customer experience from the beginning of the loan all the way through closing. And then, after the fact as well, we continue to gather that customer feedback even after the loan has closed… retain that rapport with our clients through the life cycle of a loan.”

This philosophy drives not only how Ruoff operates internally but also how their 600+ loan officers engage with clients every day: with a “hands-on, any-day-is-okay” mindset, supported by innovative technology and fast turnaround times, and of course, Experience.com!

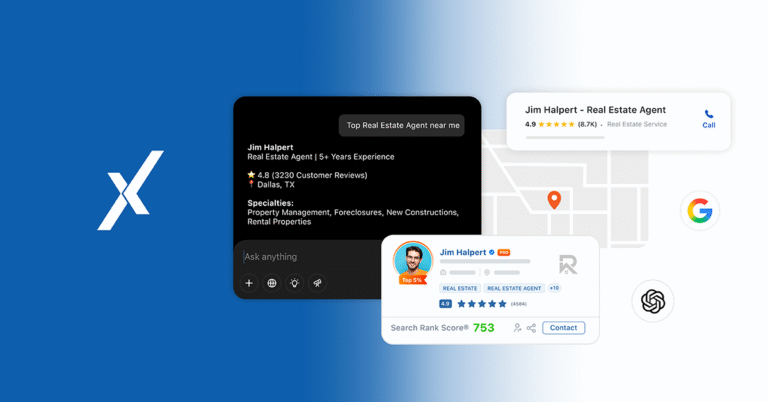

From Reputation Management to Market Visibility

When Ruoff partnered with Experience.com, the goal was to deepen its reputation management efforts while amplifying its online visibility. The results have been remarkable:

- Over 50,000 reviews collected

- An extraordinary 4.93 average rating across all profiles

- 53 loan officers ranked #1 in their zip codes

- 124 loan officers in the top 5% nationwide

- 20 loan officers recognized in the Top 500 nationally, including two in the Top 10 overall

Allen Johnson, their VP of Customer Experience, explains the impact:

“Having the online presence and visibility that Experience.com has helped us to dramatically increase is wonderful. In all the communities we serve, we have very large markets like Indianapolis, but we also have smaller communities.

And so we are coming up in the 3-Pack on Google. We are coming up on top when you look at the Experience.com Top 10 loan officers, etc.

That visibility, that presence, is definitely leading to two things: one, it’s driving organic traffic and business, and two, it also helps with our reputation management, because even though we have many of our clients that are referred to us, they’ll still Google you.”

This trust and visibility has directly translated into inbound leads. Loan officers routinely receive calls from clients who “found them online”, proof that Experience.com’s integration with Google and its focus on search visibility are delivering ROI beyond just brand building.

The Power of Personal Branding and Healthy Competition

One of the most transformative impacts of Experience.com has been on the personal branding of Ruoff’s loan officers.

Take Nicholas Boucher, Ruoff’s top performer:

- Search Rank Score (SRS): 839 (an elite ranking on Experience.com’s 850-point scale)

- 40,000+ online impressions

- 3,000+ profile views in just three months

- 776 Google interactions

Nicholas consistently ranks among the Top 10 nationally, and is currently #1 among Ruoff loan officers. His online presence is about trust; he uses his Experience.com profile as a digital business card, sending prospects to view not only his 5-star reviews but also photos with clients at closings and moments with his family.

Allen Johnson explains how this personal approach scales:

“Nick was an early adopter. So when we onboarded with Experience.com, he was eager to learn about all the capabilities and use the tools, even before I was able to do all the training. When he meets new people, he’ll be quick to point them to say, ‘Hey, go check me out online. Go look at my Experience.com page.’ He sends them the link so that they can see his reviews, and also, he’s got pictures of him at closings with clients, he’s got pictures with him with his family, and just wants to show people that it’s more than just a transaction.”

The numbers speak volumes: nine Ruoff loan officers now hold Search Rank Scores above 800, and 50 others above 700, putting them in elite company nationwide. This example set the tone for the wider team.

“Almost any week we have three to five loan officers that flip-flop in terms of that. It’s kind of created a competition,” Allen says. “You know, they see the value and the benefit.”

This consistency across the team showcases how Experience.com has shifted online visibility from an individual advantage into a company-wide strength.

To witness extraordinary results like this and fuel unlimited GROWTH yourself, get started with Experience.com’s Search Rank Platform today!

Adoption Through Training and Intentionality

Ruoff’s leadership ensured the rollout of Experience.com was not just a software switch but a cultural shift. During onboarding, they hosted 70+ training events (many in person) to help loan officers understand the simplicity and value of the platform.

Allen reflects on the approach:

“When we onboarded with Experience.com, we were all in. Once we did onboard, that meant that we were very intentional about providing a lot of training.When we onboarded, and there were no less than 70-plus events we did, and many were in-person so that we could get the hands-on adoption, because it was so drastically different than what we had had before. And again, showing them how simple the platform is to use. And then, it’s really not just about the effort, it’s just about the intentionality to use it.”

He adds:

“Take three to five more minutes and make sure you’re also optimizing Experience.com and Google. ‘Have I had any reviews in the last week? Do I have any new photos from closings or customer appreciation events I was in? Is there some content that I’d like to make in terms of a Google post?’”

This intentionality has led to consistent, small daily actions that yield significant returns. Loan officers routinely report hearing from new clients who discovered them online, sometimes leaving voicemails saying they found them on Google!

As Allen puts it: “Small investment is like planting seeds. And eventually those seeds are going to turn into a harvest, which is gonna turn into a lead like that phone call.”

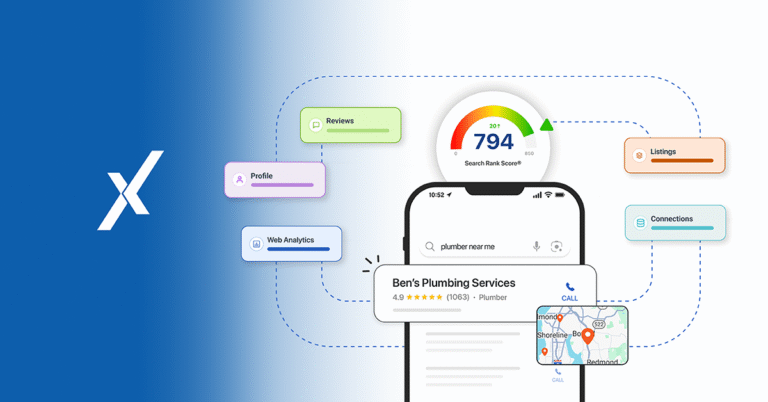

ROI in Numbers:

The ROI from Experience.com is in how it arms Ruoff’s professionals with all the right tools, and is quantifiable and compelling:

- Total Reviews: Ruoff boasts a very high number of reviews in their organization: over 51,000 reviews with a high 4.93 average score. This shows their dedication in providing excellent customer satisfaction, and collecting all these reviews leveraging Experience.com’s platform.

- Review Response Rate Doubled: With their previous provider, Ruoff achieved a 30% response rate, which they thought was brilliant to begin with. But once they onboarded with Experience.com, they now average over 60% company-wide, with some loan officers achieving 80% response rates. This is extraordinary by industry standards, which states that anything above 10% is a high response rate.

- Website SEO Boosts: By working with Experience.com to identify gaps in their Web Analytics, Ruoff’s IT team implemented adjustments that led to an average 100-point SRS increase across every loan officer. The Web Analytics feature helps professionals make their primary website more search optimized. So now it means that all Ruoff professionals have very visible and “findable” websites”.

- Increased Organic Leads: Loan officers consistently attribute new business to the improved visibility, reporting increased inbound calls and online inquiries. “We found you online” or “We found you on Google” has now become a common thing for them to hear

Extending the Win: Empowering Referral Partners

Ruoff didn’t stop at their own team. They’ve used their learnings to empower their real estate referral partners, hosting 25+ events with 450+ attendees to share strategies on online visibility.

“What we kind of emphasize on is making sure you’re optimizing Experience.com and Google. This ‘winning online’ mentality, and this assistance that Experience.com has given us the tools and the knowledge, has taken it to where now we’re sharing it with our referral partners. And this year, we’ve hosted over 25 events, had over 450 attendees, where we’ve been trying to share how they can win online too.”

This has positioned Ruoff not just as a mortgage leader, but as a thought leader in digital reputation for their ecosystem.

Looking Ahead: AI and Generative Search

While they’re thriving today, Ruoff has its eyes on the future. Allen notes:

“With Experience.com’s partnership with Google, we’re looking forward to even further optimizing our Google presence. But also, the next thing is AI. And we’ve already begun partnering with you to start to talk about GEO, you know, Generative Engine Optimization, and put ourselves in position to be at the forefront of that.”

Their marketing team is already laying the groundwork, sending daily ready-to-use content ideas to loan officers, ensuring consistency and relevancy, exactly what future AI-driven search will reward.

AI Search Is Here. Are You Ready to Be Found?

The Bottom Line

Ruoff Mortgage’s journey with Experience.com is a clear demonstration of how a customer-first culture, paired with the right technology, creates compounding ROI.

- 50,000+ reviews at a 4.93 rating

- 60–80% review response rates (double the industry norm)

- Nine loan officers with 800+ SRS and 50 above 700

- 53 ranked #1 locally, 124 in the Top 5% nationwide

- Organic leads and inbound calls directly tied to Google visibility

Allen Johnson summarizes it best:

“Experience.com has helped us take our core principle of customer experience and amplify it online—building trust, attracting new clients, and giving us actionable feedback to improve. We’ve doubled our review response rates, boosted visibility, and turned small intentional habits into major growth.”

He added:

“Experience.com has helped us take that core principle of providing a great customer experience, using it to share from a social presence, then using that to get even more voice of the customer, getting more of that actionable data, which then helps us to sharpen our own act, so to speak. And so we can get better in what we control. And then that, again, continues to help us to have a greater online visibility and the chance to attract, you know, new clients, as well as to reinforce those folks that have heard about us.”

Their combination of holistic culture and partnering with right techs have not only won them awards and industry recognition, but also helped them grow stronger, more authentic connections with customers in every community they serve.