Imagine having access to a cutting-edge tool that not only captures valuable customer feedback, but also provides actionable insights to drive your success. Experience.com’s revolutionary Experience Management Platform (XMP) is here to make that vision a reality.

Revolutionize your mortgage business using data from Experience.com!

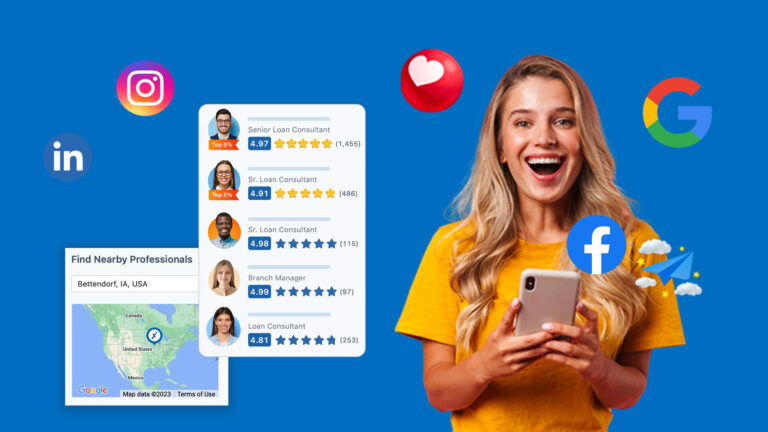

With XMP, mortgage professionals gain an unparalleled advantage, propelling their businesses to new heights. Explore how XMP empowers you to tap into the potential of mortgage experience data, drive new business, enhance customer experiences, and maximize growth.

7 Strategies to Elevate Your Brand and Empower Loan Officers

1. Craft a Compelling Online Presence: Create an online presence that captivates borrowers and showcases your brand’s unique value proposition. By tailoring your messaging to highlight the expertise of your loan officers, you’ll engage with potential clients through personalized content that resonates with their needs.

2. Harness the Power of Positive Experiences: Leverage the valuable feedback from satisfied borrowers to amplify positive experiences. Utilize testimonials and reviews across various platforms to build trust and credibility, establishing your reputation as a reliable and exceptional mortgage provider.

3. Targeted Marketing Campaigns: Customize your marketing efforts to reach specific borrower segments. Deliver tailored messages that address their needs and pain points, increasing conversion rates and attracting new business.

4. Empower Loan Officers with Actionable Insights: Equip your loan officers with valuable insights derived from mortgage experience data. Identify patterns, trends, and areas for improvement to empower your loan officers to deliver exceptional service that exceeds borrower expectations.

5. Cultivate a Referral Engine: Transform satisfied borrowers into enthusiastic brand advocates. Encourage borrowers to share their positive experiences through online reviews and referrals, creating a network of satisfied clients who bring in new business opportunities.

6. Establish a Reputation for Excellence: Manage and monitor your online reputation effectively. Respond promptly to customer feedback, address concerns, and showcase your commitment to exceptional service. By actively managing your reputation, you can build a solid foundation of trust and excellence that attracts more borrowers to your business.

7. Set Your Loan Officers Apart: Highlight the unique strengths and expertise of your loan officers. Showcase their industry knowledge, certifications, and success stories to differentiate them from the competition, positioning them as trusted advisors in the mortgage industry.

A Unified Platform to Power Everything At Scale: The XMP Advantage

With innovative strategies and a focus on customer experience, you now have the tools to elevate your brand, empower your loan officers, and drive mortgage success.

The Experience Management Platform (XMP) is a powerful tool for mortgage companies, offering a comprehensive suite of features to streamline customer feedback and drive business growth.

With the XMP, mortgage professionals have a competitive advantage as they collect, analyze, and act upon Mortgage Experience (MX) data. This solution provides valuable insights into borrower preferences, pain points, and satisfaction levels. By leveraging this information, lenders can customize their offerings, improve service quality, and stand out from the competition.

Unleashing the Power of Mortgage Experience Data with the XMP

How does Experience.com’s XMP utilizes feedback data to drive success for mortgage companies?

1. Customer-Centric Feedback Collection:

The XMP facilitates seamless feedback collection from borrowers at every touchpoint along their mortgage journey. By providing intuitive survey tools and customizable questionnaires, mortgage companies can capture valuable insights from customers. From the initial application process to post-closing satisfaction, the XMP enables companies to gather feedback that truly reflects the borrower’s experience.

2. Advanced Data Analysis:

Once feedback is collected, the XMP employs sophisticated data analysis algorithms to extract meaningful patterns and trends. Mortgage companies gain in-depth visibility into customer sentiment, identifying areas of strength and opportunities for improvement. The XMP’s analytics dashboard offers comprehensive visualizations and actionable reports, empowering companies to make data-driven decisions and prioritize areas that have the greatest impact on customer satisfaction.

3. Real-Time Insights and Alerts:

With the XMP, mortgage companies receive real-time insights and alerts based on feedback data. Instant notifications highlight urgent issues or exceptional customer experiences, allowing companies to promptly address concerns or celebrate successes. By staying informed and proactive, mortgage companies can enhance their responsiveness, build trust with borrowers, and create a customer-centric culture.

4. Performance Benchmarking:

Experience.com’s XMP goes beyond individual feedback analysis by providing valuable performance benchmarking. Mortgage companies can compare their performance against industry standards and identify areas where they excel or lag behind competitors. This comparative analysis provides valuable insights into market positioning, enabling companies to set realistic goals and continuously improve their services.

Experience.com’s XMP unlocks the true power of Mortgage Experience data, enabling mortgage companies to harness customer feedback, and turn it into a strategic advantage.

Want proof? Find out from the Leaders in the Industry!

Since February 2015

Since May 2018

Results within less than 6 months

Experience.com’s XMP Revolutionizes the Mortgage Industry

By putting the power of mortgage experience data at the fingertips of lenders and loan officers, and leveraging this data, mortgage professionals can unlock new opportunities, improve customer experiences, and drive sustainable business growth.

From collecting and analyzing customer feedback to personalizing interactions and amplifying brand reputation, the XMP empowers mortgage companies to stay ahead of the competition in a rapidly evolving market. Don’t miss out on the opportunity to leverage the XMP and take your mortgage business to new heights.

Embrace the power of mortgage experience data today and drive new business like never before.