Are you looking to revolutionize the customer experience for your mortgage company?

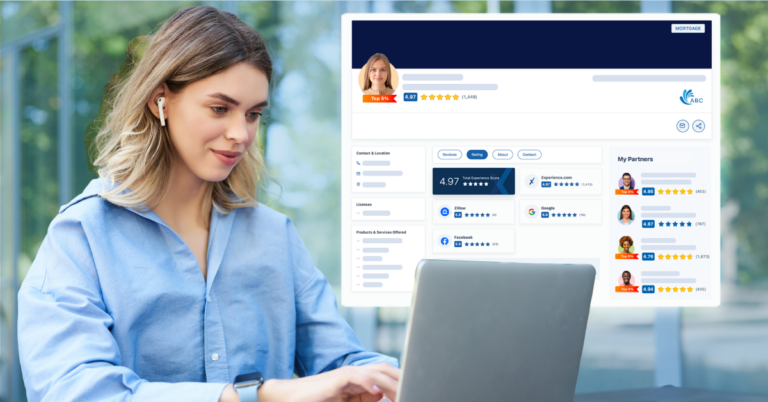

Experience.com’s Experience Management Platform and CX Solutions offer a transformative solution.

In this article, we present a sample mortgage CX plan that leverages the power of Experience.com’s tools. From identifying a key point of contact within your company to automating data connections and building personalized surveys, this plan covers all the essential steps to enhance the customer journey. By following this plan, aligned with CX best practices, you can elevate your mortgage company’s reputation, customer satisfaction, and ultimately, your business success. Experience.com’s CX solutions provide the tools and support you need to embark on this transformative journey.

Using Experience.com’s Experience Management Platform and CX Solutions, here is a sample plan that any mortgage company could follow:

- Key Point of Contact – Identify a key point of contact within your company and a dedicated resource to manage and move workflows, as well as add, remove and train users.

- Company Hierarchy – Add all agents, locations, regions and corporate offices, along with all marketing and CX leaders, into the campaigns and alerts.

- Automate Data Connections – Connect Experience.com to your loan origination system. At funding of the loan, automatically request feedback from the customer on behalf of the loan officer.

- Survey Build – When the loan closes, send a personalized survey to the borrower aliased from their loan originator. Ask survey questions specific to the items completely in the loan officer’s control. Any additional questions (non-loan originator specific) should be excluded from the loan originator’s rankings.

- Partner Surveys – At funding, also automatically request feedback from real estate agent partners to enhance existing relationships and create new ones.

- Share Reviews – Connect to company websites, social media pages and relevant third-party reviews sites (focusing on Facebook, Twitter, LinkedIn, Zillow and LendingTree for all loan officers, branches, regions and corporate locations.) Build workflows that will allow sharing to all possible loan originator profile pages and location and company pages.

- Third-Party Reviews – Ask all customers to write additional third-party reviews using a flexible workflow on sites like Google My Business, BBB and Credit Karma.

- Reply to Reviews – Pull all reviews from all locations, such as Google and Facebook, into a single dashboard so your team can easily monitor and respond.

- Dashboards – Develop an agent, branch, region and company dashboard for real-time stats, leaderboards and sharing. Create quick edits, bulk edits and quick add features for your management team.

- Drive Competition – Create a loan officer scorecard and real-time leaderboard to include customer satisfaction rating, volume of reviews and completion rate. Rank agents and include ranking offset for completion percentage.

- Resolution Workflows – Develop unhappy customer workflows that automatically apologize, collect feedback and escalate issues to location, region and corporate managers. Ideally, notify your customer care team and map the transaction ID so they can easily pull file notes prior to calling the customer.

- Location Data – Use Google, Yelp, Facebook and Infogroup APIs to manage all locations’ NAP data (citations) across 100+ Tier 1 and Tier 2 websites.

You can see the above plan meets and follows the CX best practices. This exercise is important when building your strategy. Every business is different, and you may not be able to start with full adoption and/or a complete strategy all the time, but wherever possible, try to implement these practices.

Experience.com’s CX solutions are a game-changer for mortgage customers, providing them with an exceptional customer experience throughout their journey.

By utilizing the CX platform and automated surveys, mortgage lenders can collect and analyze valuable insights that power their next best actions. This enables them to optimize the customer experience, resulting in increased revenue, improved customer engagement, and reduced churn and costs.

With journey-based surveys, mortgage lenders can gather feedback on what customers love and areas that need improvement. This information is then used to make meaningful enhancements to the business, tailored to individual customer needs. By acting on customer feedback, lenders can enhance their reputation, drive loyalty, and ultimately grow their business.

Experience.com’s open platform simplifies the connection to advanced technology, allowing for seamless collection of transaction data and automated personalized requests. The platform also offers a comprehensive suite of business intelligence integrations and features. With real-time insights, customizable dashboards, advanced reporting, and predictive analytics powered by AI and machine learning, mortgage lenders can make data-driven decisions and gain a competitive edge.

The CX solutions provided by Experience.com also prioritize compliance and control. The Experience Management Platform (XMP) offers a range of features to manage all aspects of the customer experience, ensuring regulatory compliance and maintaining control.

Experience.com’s unwavering commitment to customer service and support is evident through their comprehensive help center, AI chatbot, and phone support team. Enterprise clients receive personalized support from a white glove success manager, and the XPA certification program equips users with the knowledge and skills to effectively leverage the platform.

In summary, Experience.com’s CX solutions empower mortgage lenders to enhance the customer experience, increase revenue, and improve engagement. By leveraging valuable insights, advanced technology integration, and comprehensive support, mortgage lenders can dominate the industry and achieve their business goals.